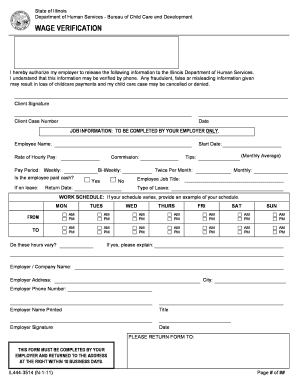

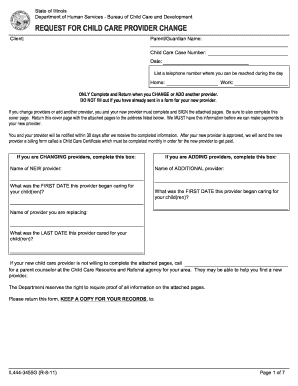

IL IL444-3415 2011-2024 free printable template

Get, Create, Make and Sign

How to edit wage verification form online

How to fill out wage verification form

How to fill out wage verification form:

Who needs wage verification form:

Video instructions and help with filling out and completing wage verification form

Instructions and Help about dhs wage verification form

We reported extensively on this broadcast for years about state governments taking action to enforce immigration laws state governments forced to do so because of the other failure of our federal government to enforce the law but here in the state of Illinois it's a much different situation in fact as Christine Romans now reports the entire state is something of a sanctuary for illegal aliens welcome to Illinois a state the federal government says blocks the enforcement of immigration law the Justice Department is suing Illinois for prohibiting employers from enrolling in e-verify a web-based tool to verify legal status of new hires Illinois is quoted interfering with the federal government's approach to enforcing federal immigration laws in a state with one of the largest populations of aliens not lawfully present in the United States the suit calls illegal immigration quote a substantial problem attributable to employers who violate federal law, but the legislature here overwhelmingly opposes Over phi the governor signed legislation passed by both chambers that prevents employers from using this tool a spokeswoman says quote the governor agreed with the majority of legislators who said we should not be using a database riddled with errors Department of Homeland Security says 93% of queries come back accurately within one day the state says that's not good enough Republican Congressman Peter Rosa says his state rewards illegal immigration so here it is a tool that's out there, and we've got an administration in Springfield Illinois that's going to deny that to Illinois employers I think that's the wrong thing to do also wrong Rosa says is an initiative supported by the governor for drivers certificates for people in the country illegally at the same time Illinois congressman RAM Emanuel a top democratic strategist has called illegal immigration the new third rail in American politics something no one wants to touch Josh Host is the director of the Illinois Coalition for immigrant and refugee rights the immigration debate has descended into the realm for bigots and bullies and demo host says a path to citizenship for those here illegally must go hand in hand with enforcement and border security I think that the position that RAM Emanuel has been advocating within the Democratic Party is moral cowardice what this country wants our solutions not politicians that run and hide any time Lou Dobbs calls them part of the amnesty lobby a spokesperson for congressman Emanuel says quote neither Josh nor his comments are worthy of a response here in Illinois illegal immigration remains a contentious issue as you can see the federal government estimates that Illinois has the fourth largest population of illegal aliens in the country loop

Fill wage and salary verification form : Try Risk Free

People Also Ask about wage verification form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your wage verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.